How to get my w2 from amazon former employee.

A subreddit for current, former and potential Amazon employees to discuss and connect. If you have any questions, comments or feedback regarding the subreddit, please feel free to send us a message through modmail. Please note: We are not a customer support subreddit, please reach out to appropriate contact points for assistance with your order.

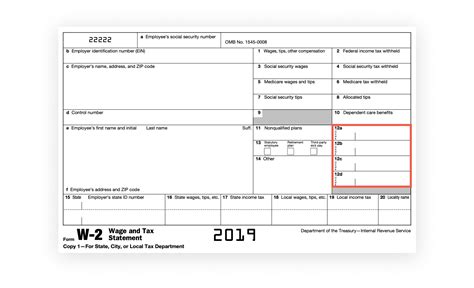

Info about W2 for former employees! Hey there, former employee here. I've spent the last couple days trying to figure out how to retrieve my W2 for 2022. Nothing was showing up on the mytaxform.com website. I called their number 877-325-9239 and you HAVE to press 4 and then 1 AFTER you verify all of your info. Page Last Reviewed or Updated: 29-Jan-2024. Information about Form W-2, Wage and Tax Statement, including recent updates, related forms and instructions on how to file. Form W-2 is filed by employers to report wages, tips, and other compensation paid to employees as well as FICA and withheld income taxes. This includes your Social Security number, your date of birth, and your mailing address. Once you have this information, you can request your W2 in one of three ways: 1. Call the Wendy’s corporate office at 1-614-764-3100 and ask for the HR department. They will be able to help you request your W2.Guide to Accessing and Downloading your W2 Form. To access your W2 form from Kohl’s, you can follow these simple steps on the MyHR website: 1. Start by opening a web browser and navigating to MyHR.Kohls.com. This is the official website for Kohl’s employees to access their HR information. 2.

Access your employee documents, such as pay stubs, tax forms, and benefits information, with your Amazon login credentials.

A subreddit for current, former and potential Amazon employees to discuss and connect. If you have any questions, comments or feedback regarding the subreddit, please feel free to send us a message through modmail. Please note: We are not a customer support subreddit, please reach out to appropriate contact points for assistance with your order.

Federal income tax rates and withholding often seem opaque to both employees and employers. As an employee, you are surprised to see that your paycheck is well below what you might...If directly reaching out doesn’t help, it’s time to contact the IRS. If your former employer does not act on your request for following up on your W-2 or you are unable to reach them, then it is time to reach out to the IRS. Provide the IRS with: Your name, address, Social Security number and phone number. Employer’s name, address …If directly reaching out doesn’t help, it’s time to contact the IRS. If your former employer does not act on your request for following up on your W-2 or you are unable to reach them, then it is time to reach out to the IRS. Provide the IRS with: Your name, address, Social Security number and phone number. Employer’s name, address …Employee W2 forms are an important document for both employers and employees. They provide information about an employee’s wages and taxes, which is necessary for filing taxes and ...

Tax Forms Now Available. The 2022 W-2 and 1095-C forms were either mailed or made available on Jan. 31. If you have any questions about your tax forms, please call the EmployeeCentral Contact Center at 855.475.4747, option 1. If you opted to receive your tax forms online, here's how you can access them: W-2 Form for CHI-Affiliated …

Once you have your registration code, you can register at login.adp.com. Employee Registration. Select Register Now to start the registration process. Follow the steps to enter your registration code, verify your identity, get your User ID and password, select your security questions, enter your contact information, and enter your activation code.

Views: We can give you copies or printouts of your Forms W-2 for any year from 1978 to the present. You can get free copies if you need them for a Social Security-related reason. But there is a fee of $126 per request if you need them for an unrelated reason. You can also get a transcript or copy of your Form W-2 from the Internal Revenue Service.thegingergirl98. You won’t be able to find your W-2 digitally. The only way to get them as a former employee is via mail. You’ll just have to call HR and wait. Or, if you haven’t already, set up mail forwarding from the USPS. They’ll send it to your new address.Former employees can change their address with Leidos for W-2 or tax purposes. Download the form. 401(k) changes. Former employees will need to make address changes directly with Vanguard, either by phone at 800-523-1188 or logging into your account. go to vanguard.com.To log in to your The Work Number account online, you will need your company name or their employer code. Step 1 • Identify Your Employer. After clicking Sign Up, select “Not A Robot" before continuing. Enter the employer code associated with your employer or search for your employer by name. Step 2 • Log In and Confirm Your Identity.Answered April 8, 2021 - Member Service (Current Employee) - Binghamton, NY. ADP is the co that shows us our paystubs, hours worked, and tax forms. Upvote 4. Downvote. Report. Answered June 27, 2020 - Staff (Former Employee) - Rockland, ME. You can use an app called ADP. Upvote 3. Downvote.

If you've been terminated you can still go to myhr, where the Former Employee login is, sign up as a 'new user'. After you set it up you can get into a modified version of HR. I was told the W2's will be available there to former employees on the 15th of Feb. Don't think I won't report those assholes if it's not postmarked before the 31st ...Stanford must report all employee taxable wages and the associated taxes paid to federal and state agencies. At the beginning of each tax year (Jan. 1 to Dec. 31), Stanford sends a completed W-2 Wage and Tax Statement Form (W-2 Form) to each employee, which they can use when filing their federal and state income tax returns (refer to Resource: W-2 Form Fields and Descriptions). Rejoin Amazon in 3 simple steps: 1) Log in to your Amazon Jobs account. 2) Start and complete application. 3) If you’re eligible, skip your New Hire Event and get ready for your Day 1. Get rehired. Allow 10 business days after January 31 before asking for a reissue of your W-2. Intel employees: Visit Circuit Home > Pay and Benefits > Compensation > Pay > Managing Your Pay > Tax for Withholding Tax forms: Federal (W-4) and State. Visit Workday: Click menu > Pay > scroll to View box for W2 breakdown, payslips, and tax …VDOM DHTML on="1.0" encoding="UTF-8"?>. Submit Form. Note: Since your browser does not support JavaScript, you must press the Resume button once to proceed.Employee W-2 Information. You review employee W-2 information online to see how the information appears on the actual form before you print it. If the employee worked in more than one state and all federal wages are to be printed on one form, the system displays this message: “Federal wages printed on another W-2 for all state and local forms ... If you have previously logged into the ADP portal to get your paystub or W-2 from your former employer, you can try and access your information. If you are unable to log in, your former employer may have removed your online account.

Contact the human resources department: Contact the human resources department at Buffalo Wild Wings to inquire about the status of your W2. Provide your name, employee ID, and last known mailing address to ensure that they have the correct information on file. Check your mailing address: Verify that your mailing address on file …Apr 3, 2024 · We'll contact your employer and request the missing W-2. We'll also send you a copy of Form 4852, Substitute for Form W-2, Wage and Tax Statement. You can use this to file your tax return without your W-2. If you don't get a W-2 in time to file your taxes. Use your paycheck stubs to estimate your wages. Then complete Form 4852 and attach it to ...

Category: personal finance personal taxes. 4.5/5 (2,426 Views . 39 Votes) To view or print your W-2 Statements, click here to access Employee Self-Service. If you are unable to print your W-2 statement through Employee Self Service, please contact the HR Service Center at 1-866-myTHDHR (1-866-698-4347) or [email protected]. In respect to ...We would like to show you a description here but the site won’t allow us.Employee W2 forms are an important document for both employers and employees. They provide information about an employee’s wages and taxes, which is necessary for filing taxes and ...Federal income tax rates and withholding often seem opaque to both employees and employers. As an employee, you are surprised to see that your paycheck is well below what you might... We would like to show you a description here but the site won’t allow us. If directly reaching out doesn’t help, it’s time to contact the IRS. If your former employer does not act on your request for following up on your W-2 or you are unable to reach them, then it is time to reach out to the IRS. Provide the IRS with: Your name, address, Social Security number and phone number. Employer’s name, address …Page Last Reviewed or Updated: 29-Jan-2024. Information about Form W-2, Wage and Tax Statement, including recent updates, related forms and instructions on how to file. Form W-2 is filed by employers to report wages, tips, and other compensation paid to employees as well as FICA and withheld income taxes.

In today’s digital age, businesses are constantly seeking ways to streamline their operations and improve efficiency. One area that often proves to be time-consuming and resource-i...

Jan 29, 2021 · If you worked for Amazon Flex during the previous tax year, you will need to obtain a W2 form to file your taxes. To get your W2 from Amazon Flex, follow these steps: Log in to your Amazon Flex account on the Amazon Flex website. Click on the “Tax Information” tab. Click on the “Download” button next to your W2 form. Save or print your ...

Also, it's possible that your mobile carrier has blocked Amazon's text messages. Please call your carrier to unblock text messages. If you used an email address: First, check your spam folder and confirm your inbox is not full. Next, check if sender ([email protected]) is blocked in your email preferences. If you have previously logged into the ADP portal to get your paystub or W-2 from your former employer, you can try and access your information. If you are unable to log in, your former employer may have removed your online account. How do I access my W-2 from a previous employer? If you have previously logged into the ADP portal to get your paystub or W-2 from your former employer, you can try and …Technically, your employer has until Jan. 31 to send your W-2 by mail or electronically. If they mailed it on Jan 31., it may take a few days to arrive. If your employer participates in the early W-2 program, you can use H&R Block software to import your W-2 directly to your return. You can also consult a tax pro at an H&R Block tax office for ...Updating Tax Information. Log in to Amazon Associates Central. Click on your email in the upper right hand corner. Click “Account Settings”. Scroll down to View/Provide Tax Information. Your Current Tax Status will be displayed. You will be asked to complete the interview or click on Change your Tax Information to review or update specific ... A subreddit for current, former and potential Amazon employees to discuss and connect. If you have any questions, comments or feedback regarding the subreddit, please feel free to send us a message through modmail. Please note: We are not a customer support subreddit, please reach out to appropriate contact points for assistance with your order. In today’s digital age, many businesses are transitioning from traditional paper-based systems to online platforms for managing various aspects of their operations. One area where ...Get Form W-2 As A Former Employee As a former employee of Amazon navigating the intricacies of obtaining your Form W-2, the following options are available to facilitate a seamless process for filing last year’s tax returns, even if you are no longer employed by Amazon.Hi, I am a former employee of Dell and have not received my W2 form yet. I was wondering who I could get in contact with to provide my new address so I can get the W2 form sent to me?

Use the TurboTax W2 Finder. TurboTax free file allows you to use their W2 finder for free and have an electronic copy sent to your account at TurboTax. All you have to do is follow a few steps to find your W2 online. TurboTax will help you import your W-2 directly from your employer using their Employer Identification Number (EIN).7. Click on the “W2 Retrieval” button; this will take you to the ADP W-2 website 8. Once you’re on the ADP website, click Download Statement to access your W-2 Need support? Please contact HR Direct at 866.473.4728 with any questions. Thank you. L Brands Payroll Tax DepartmentYou need to make a new account using the amazon employer code included into your termination paperwork. It’ll ask you for personal information to confirm identity, and then …Instagram:https://instagram. fox auction memphis mo329 bar and grill menu hartwell gadaily times obituaries maryville tnlilbourn mo obituaries Answers for other frequently asked questions. If you would like to verify employment for former or current HCA employee, please contact Thomas and Company at (615) 242-8246. Our employer code is HCA747. If you have questions about stock, please see the Investor FAQs on their Investor Relations page. If you need to obtain patient records for ... 66 john street new york new yorkbrickschools.org parent portal Note: Since your browser does not support JavaScript, you must press the Resume button once to proceed. craigslist lynchburg va farm and garden Once your employee account is set up, follow these steps to access your pay stub: Log in to your Amazon employee account using your registered email address and password. Navigate to your account dashboard’s “Payroll” or “Earnings” section. Look for the option to view or download your pay stub for the desired pay period.Contact the human resources department: Contact the human resources department at Buffalo Wild Wings to inquire about the status of your W2. Provide your name, employee ID, and last known mailing address to ensure that they have the correct information on file. Check your mailing address: Verify that your mailing address on file …